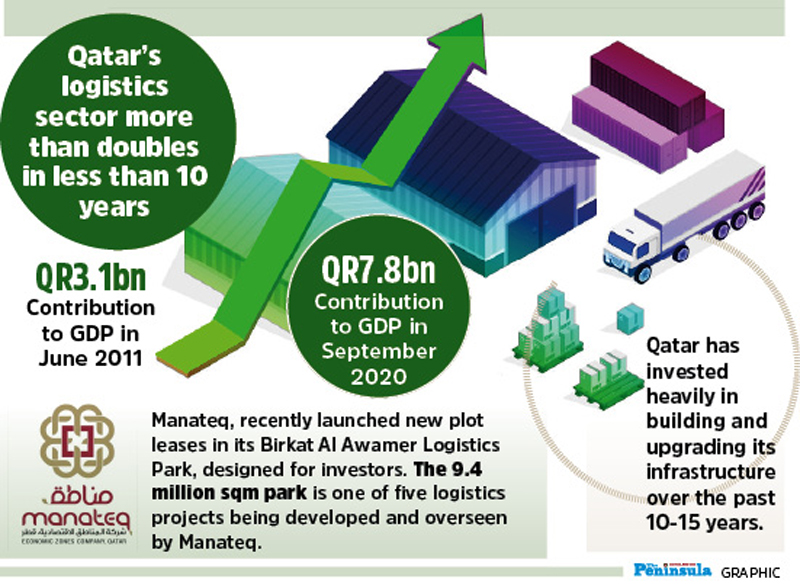

Qatar’s logistics sector witnessed a remarkable growth over the last one decade, and its contributions to gross domestic product (GDP) more than doubled in less than 10 years to QR7.8bn in September 2019 which stood at QR3.1bn in June 2011, said a senior official of PwC.

Qatar has been investing heavily in developing key infrastructure facilities, including logistics parks, a wide network of roads, expressway, world-class sea port and airport, and many other sectors, which have started bearing fruits and attracting huge investments in several other sectors of the economy.

“Qatar has invested heavily in building and upgrading its infrastructure over the past 10-15 years. That included a state-of-the-art port, modern airport, expansive network of highways, Qatar Free Zones, and Industrial Cities and Logistics parks being developed by Manateq (Economic Zones Company-Qatar). In September 2019, logistics contributed QR7.8bn to Qatar’s GDP as compared to QR3.1bn back in June 2011,” Dr. Bashar El Jawahari, Partner PwC, told The Peninsula in an interview, yesterday.

Dr. El Jawahari, who leads the Industry 4.0, procurement and supply chain competency in the Middle East, added: “Infrastructure and logistics are typically enablers of economic growth as they facilitate the integration of Qatar economy into the economies of the world. They allow for the efficient exchange of raw materials and manufactured goods between Qatar and the rest of the world. Among the many components of trade costs is transportation, distribution and logistics costs.”

Manateq, the sate-owned company, which is is currently focusing on the development of its various logistic parks, recently launched new plot leases in its Birkat Al Awamer Logistics Park, designed for investors. The 9.4 million sqm park - one of five logistics projects being developed and overseen by Manateq (Al Wukair, Aba Saleel, Al Wakra, Jery Al Samur, and Birkat Al Awamer) - is designed to appeal to companies wanting to build their own facilities through providing them comprehensive solutions that will allow them to build warehouses or workshops, commercial showrooms, offices, and staff accommodation all in one piece of land. The project has received overwhelming response from investors.

Commenting on the role of a well-developed logistics sector in attracting investment, El Jawhari (pictured) added that from a micro-economic view, the cost-effectiveness of logistics can have a major bearing on an organization’s decisions about which country to locate in, which suppliers to buy from, and which consumer markets to enter.

“From a macro-economic angle, high logistics costs to GDP are a barrier to trade and foreign direct investment (FDI), and thus to economic growth. Countries with lower overall logistics costs are more likely to take advantage of globalization opportunities.”

Referring to a recently study estimates, he noted that a 10 percent increase in transport costs reduces trade volume by 20 percent and doubling shipping costs hinders GDP growth by 0.5 percent. Therefore, Qatar focused on modernising its infrastructure and logistics as one of the foundation blocks for its economic growth.

El Jawhari, with a wealth of over 20 years of experience in localization, supply chain and operations, strategy development, lean transformation, said that this will work as a major driving force in accelerating the economic diversification and sustainable development of the country.

Speaking on the major challenges and opportunities facing the local businesses, especially the SMEs and startups, he highlighted the economic and financial support extended by various government agencies, including the Qatar Development Bank (QDB).

“In recent years, Qatar has been focused on growing its local base of manufacturers and service providers. For example, QDB provides funding to support the launch of SMEs. Qatar Business Incubation Center (QBIC) helps entrepreneurs and companies who either have an idea to start a business or want to grow an existing business. More recently, QP launched its Tawteen programme to localise services and goods and attract investors. However, more work is still needed to support the SMEs and address their challenges,” he added.

“For SMEs to access funds from QDB or any commercial bank, they need to provide sound business plans and feasibility studies. Such studies require the availability of market statistics and imported information. Some of the small investors may not have the funds to commission feasibility studies or struggle to find market demand data.”

El Jawhari said that SME entrepreneurs may lack the knowledge on how to develop business plans, marketing plans, license requirements, and so on. Hence, the presence of an entity to assist them develop such knowledge is critical. It will also be essential to have a database of potential competitors or suppliers.

“Finally, depending on the market size in Qatar, SMEs may need assistance to export their products or services. Therefore, they will need the government’s support to promote “Made in Qatar” and leverage Free Trade Agreements (FTA) to open export markets,” he noted.